sales tax in san antonio texas calculator

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. There is no applicable county tax.

Texas Sales Tax Rates By City County 2022

The minimum combined 2022 sales tax rate for San Antonio Texas is.

. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. The December 2020 total local sales tax rate was also 8250. This is the total of state county and city sales tax rates.

Maximum Local Sales Tax. Sales tax in San Antonio Texas is currently 825. Texas Sales Tax.

Add your county or city - and the tool will do the. Average Local State Sales Tax. In-Person Delivery Please direct these items to the new City Tower location City of San Antonio Print Mail Center Attn.

The sales tax jurisdiction. The current total local sales tax rate in San Antonio TX is 8250. PersonDepartment.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. San Antonio TX 78205. You can find more tax rates and.

The calculator will show you the total sales tax amount as well as the county city and. Simply download the lookup tool and enter your state in this case Texas. The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio.

If purchased in Texas on or after 912019 and combined vesseloutboard motor sales price is over 30000000 vessel and outboard motor prices must be entered separately to calculate. Real property tax on median home. Isle of Palms SC.

Texas State Sales Tax. While many other states allow counties and other localities to collect a local option sales tax Texas does. Thats why we came up with this handy Texas sales tax calculator.

Texas residents 625 percent of sales price less credit for. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Sales Tax State Local Sales Tax on Food.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

What is the sales tax rate in San Antonio Texas. Counties cities and districts impose their own local taxes. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in San Antonio TX.

Maximum Possible Sales Tax. There is base sales tax by Texas. US Sales Tax Texas.

Calculator for Sales Tax in the San Antonio.

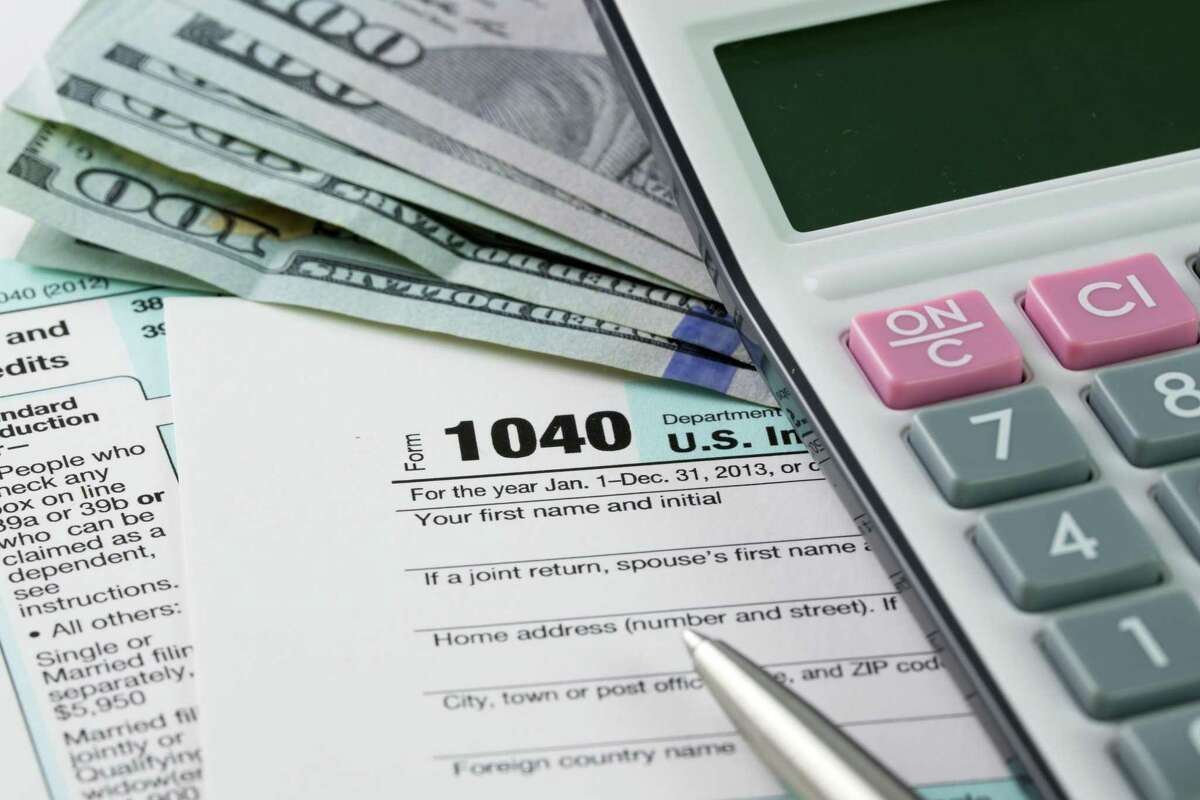

Texas Income Tax Calculator Smartasset

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Know Your Sales And Use Tax Rate

Jbsa Tax Centers Open For Business Joint Base San Antonio News

Calculation Error Could Result In Higher Tax Bills For Schertz Residents

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Calculate California Sales Tax 11 Steps With Pictures

Texas Sales Tax In 2017 What You Need To Know The Motley Fool

Tax Rates Bexar County Tx Official Website

10 25 Sales Tax Calculator Template

Zachry Construction On Twitter Corporate Office Opportunity We Are Seeking A Tax Accountant With Experience In Texas State Sales And Use Tax Laws Construction Industry Preferred Please Apply Online Here Https T Co 2qkfpnskac Come

Sales Tax By State Is Saas Taxable Taxjar

Are Ltd Benefits Taxable Your Guide To Disability Insurance Taxation

Tax Implications When Selling Your Texas Rental Property Cyber Homes